Even as carbon markets face scrutiny relating to a lack of environmental integrity, low transparency, and unrealistic commitments, there are good reasons to be optimistic. Innovators in Africa are building on the continent’s natural resources, economic growth, and tech talent to create new types of carbon projects that are better integrated into communities and markets, delivering social, economic, and environmental benefits.

Even as carbon markets face scrutiny relating to a lack of environmental integrity, low transparency, and unrealistic commitments, there are good reasons to be optimistic. Innovators in Africa are building on the continent’s natural resources, economic growth, and tech talent to create new types of carbon projects that are better integrated into communities and markets, delivering social, economic, and environmental benefits.

This supply of carbon credits cannot get to market fast enough. Both the Voluntary Carbon Market (VCM) and compliance markets more than doubled in value between 2020 and 2022 as an increasing number of corporations and governments in the Global North seek to execute voluntary or mandatory Net Zero commitments. In 2022, $2 billion of carbon credits were traded on the VCM, more than doubling since 2020. The volume of credits required globally is expected to increase at least 20x by 2035, with 30 to 40x needed for scenarios consistent with the Paris Agreement on climate change. To harness this opportunity, we need to establish African markets as attractive destinations for private sector investment, and support African innovators to navigate the carbon value chain.

The credible supply of carbon credits is becoming increasingly constrained, which will drive up the costs of climate action

Growing demand, coupled with the exhaustion of low-cost solutions, is fueling the need for new sources of carbon credits beyond the afforestation, reforestation, and restoration projects that currently dominate supply. According to BeZero, meeting carbon removal targets by nature-based removal alone would require the afforestation of land larger than the US.

That demand is forecast to drive the price of carbon credits on the VCM up to US$ 80-$150 per tonne by 2035, as compared to today’s price, which ranges from US $2 to US$ 25 per tonne. A two-tier market is developing – with projects perceived to demonstrate high quality and integrity fetching prices upwards of $20 per tonne while the rest of the market trends below $5.

“The controversial news around the quality of offsets is driving corporates to find that middle ground that can be transparently confirmed as not greenwashing, but that still includes a price per ton that the boards find reasonable.” – Eve Tamme, Inside Climate Policy.

To meet this challenge, we need to diversify sources of carbon credit supply; improve market access for African projects; and harness new tools and approaches that enable scale, rigor, and speed by:

- Growing investment: Under-investment, not lack of carbon potential, explains why emerging markets have been marginal players in the carbon value chain to date. To attract investment, project developers need to adapt to realities in these markets, and authorities need to develop pragmatic regulatory frameworks that balance the interests of government, communities, and the private sector and provide long-term certainty.

- Supporting new project types and methodologies: We need to expand “traditional” carbon projects, such as forestry and solar energy – which account for over 70% of African carbon credits – while also supporting innovative, new methodologies in nature-based solutions and engineered removals (eg. Direct Air Carbon Capture, enhanced rock weathering, biochar). We also need to adapt and scale improvements in Monitoring, Reporting, and Verification (MRV) technology to drive down implementation costs while maintaining rigor and supporting the deployment of new innovations coming online.

- Reinforcing the value of both removal and avoidance credits: Given the scale of the climate crisis, we need an “all of the above” approach to climate action. Singularly focusing on removals ignores the role avoidance projects can play in charting a sustainable path toward an African middle class. Overly emphasizing one type of credit will also hinder supply, especially since many removal technologies are not yet scaled.

- Improving market access: While demand for carbon credits is growing, the VCM still only represents around 1% of the global carbon market value. Opening up access for foreign projects to sell into compliance markets – in particular, the EU Emissions Trading Scheme (ETS) – would drastically expand the market for African carbon credits and drive up prices (the EU ETS currently trades at US$ 106 per tonne of carbon).

Africa can be a hub for high-impact, cost-competitive carbon credits

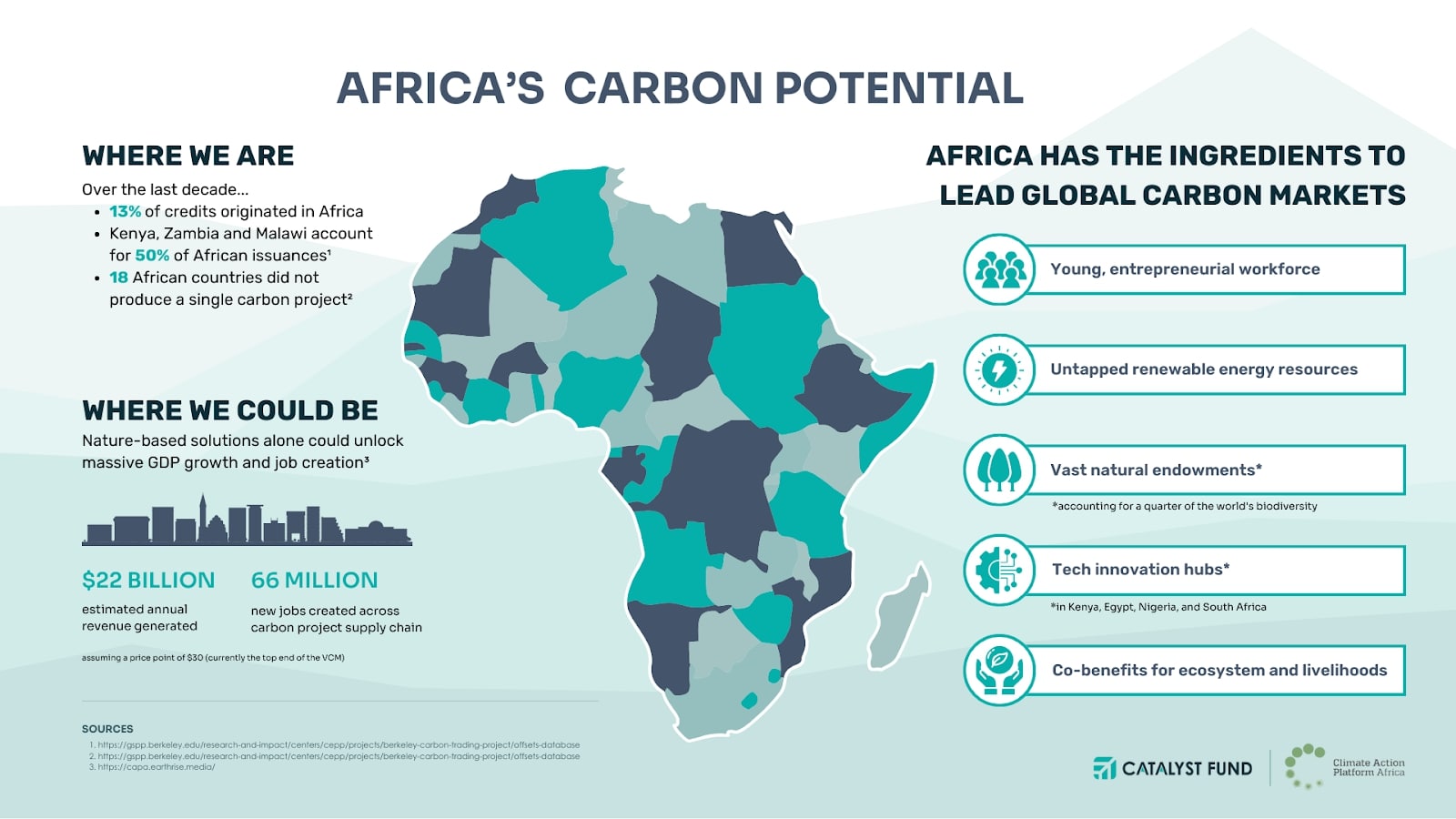

Africa is just starting to scrape the surface of its carbon project potential. Over the last ten years, just 13% of VCM credits retired originated in Africa, and just three countries – Kenya, Zambia, and Malawi – accounted for 50% of those credits. A total of 18 African countries did not produce a single carbon project.

Although the number of projects is currently low, Africa has all of the ingredients for building a stream of low-cost, high-quality carbon projects thanks to:

- A young, entrepreneurial workforce with the potential to be up-skilled and deployed across the carbon project supply chain.

- Significant untapped renewable energy resources that can provide low-cost renewable inputs for energy-intensive removals (eg. DACC) and harness carbon financing for renewable energy infrastructure.

- Massive natural endowments, including forest, coastal, and rangeland ecosystems, are critical carbon sinks and house vast biodiversity.

- Tech innovation hubs with the potential to drive innovation around project implementation, engineered removals, and MRV technology.

- Strong co-benefits by virtue of local socio-economic diversity and market structures. For example, a biochar project creates local jobs, improves livelihoods for small-holder farmers, drives food security, and regenerates degraded soil. These co-benefits mean that carbon projects can achieve both climate and development goals.

Growing the number of carbon projects in Africa is critical not only to meeting global demand but also because of the economic opportunity it represents. A recent study by Climate Action Platform – Africa (CAP-A) found that nature-based carbon removal opportunities alone can drive US$ 15 billion in annual revenue and generate improved livelihoods and new jobs for over 85 million Africans.

The Catalyst Fund is supporting real innovation in the carbon market

At the Catalyst Fund, we partner with founders to build a more resilient future by backing tech-enabled startups seeking to improve the resilience of underserved, climate-vulnerable communities in Africa. Although our focus is primarily on adaptation and resilience, we are finding that many models have mitigation benefits and that carbon finance can enable inclusive business models that were previously unviable, driving access and affordability.

In Morocco, Sand to Green is using agroforestry and solar-powered desalination to fight desertification and build food security

Sand to Green transforms deserts into cultivable land by creating climate-smart regenerative farms, providing valuable sustainable livelihoods as well as fruit and vegetables that shore up food security.

More than 83% of countries in Africa are vulnerable to desertification, and 66% of land is arid or desert. In particular, Morocco is experiencing severe water scarcity, even as 85% of national water consumption is swallowed by intensive agriculture oriented to export produce, explaining high rates of degradation.

While pressure on water resources is high, adoption of sustainable land and water management practices is low, at only 8%, pointing to a need for scalable solutions. Sand to Green is meeting this need by restoring desertified land and transforming it into sustainably managed plantations. Their methodology quantifies carbon sequestered through above-ground biomass and improved soil carbon while providing valuable jobs as well as a nutritious food supply, unlike forestry efforts which are exclusively focused on carbon.

Octavia leverages Kenya’s unique natural endowment to revolutionize direct air carbon capture

To date, almost all innovation in Direct Air Carbon (DAC) capture has been driven by companies in Europe and the USA. Octavia’s technology filters CO2 directly from the air, which can then be permanently stored underground or turned into climate-neutral carbon products, such as sustainable aviation fuels. Octavia is the Global South’s first DAC company, part of a growing cohort of African companies innovating in engineered removals.

Octavia’s aim is to make Kenya the world’s most cost-effective hub for building and deploying DAC, disrupting the current market leaders in the Global North. Octavia’s cost advantage is driven by Kenya’s abundant geothermal energy supply, which enables it to run its DAC machines on low-cost renewable energy, thereby minimizing lifecycle emissions. Octavia also manufactures its machines in Kenya, taking advantage of lower-cost talent on the continent while creating much-needed jobs.

Farm to Feed rescues imperfect food, lowering decomposition, improving incomes, and growing food security

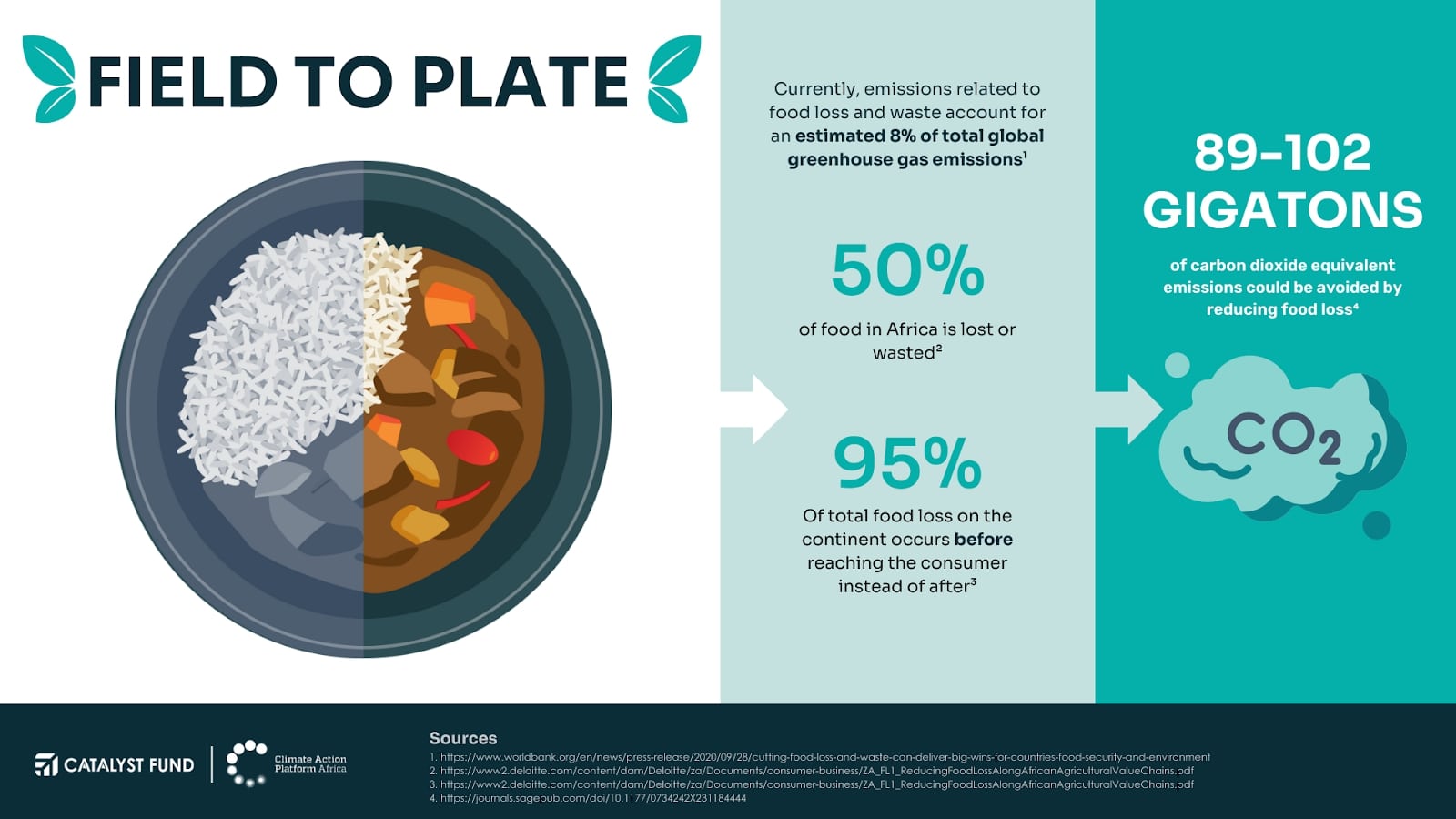

In Africa, a huge portion of food is lost or wasted (one estimate puts it at 37% while others put that number as high as 50%). Food loss and wastage in developed markets skew in favor of wastage (after food has reached consumers), but on the continent, the proportion of food lost before reaching consumers is 95%.

This loss is tragic given that 140 million Africans regularly face catastrophic food insecurity and more than 20% of the population is undernourished. Tackling food loss is a critical strategy for addressing food security and for improving the incomes of vulnerable farmers, who see much of their harvest go to landfill.

Farm to Feed reduces food waste by selling imperfect produce directly to clients at about half the market price. Farmers earn more for their efforts, buyers access produce at lower prices, and carbon emissions are avoided because less food ends up rotting in landfills. Since food waste contributes about 10% of GHG (food waste/loss releases methane), Farm to Feed is reducing emissions in the food supply chain, while also increasing farmers’ income.

African innovators need more support navigating the carbon ecosystem

Carbon project development is complex and constantly evolving. At the Catalyst Fund we are working with founders to help provide access to the resources and expertise needed to navigate key challenges, including navigating carbon certification for novel project categories, carbon commercialization strategies, and helping to secure the investment needed to get to market. Meanwhile, CAP-A is working across the ecosystem to connect the dots between policy-makers, innovators, the private sector, and philanthropy to drive the growth of liquid, high-integrity carbon markets in Africa.

But more work is needed to kickstart Africa’s carbon value chain:

- Capital providers need to develop vehicles to increase the availability of project finance and reduce the cost of capital so that many more African projects make it to market.

- Registries and project developers need to work with local stakeholders to adapt methodologies and approaches to ensure they are fit for the emerging market context and help reduce transaction costs by localizing the carbon value chain.

- Innovators need to help streamline project implementation so that more projects are commercially viable and a greater proportion of carbon revenue can find its way back to local communities

- African governments and authorities need to (1) create sufficient regulatory certainty and clarity to make African countries attractive destinations for investment in the carbon value chain – including ensuring Article 6 compliance, and (2) create an enabling environment for local innovation and project development.

- Policymakers in the Global North need to help advocate for foreign compliance market access, drastically expanding the market for African credits.